Adjustable-rate mortgages (ARMs), when used appropriately, can help ease affordability challenges and provide homeownership and equity building opportunities for qualified borrowers.

With the recent steepening in the yield curve, the spread between ARM and fixed-rate mortgage rates has widened. Over the past four weeks, ARM rates averaged 80 basis points lower than the 30-year fixed rate and reached almost a full percentage point spread the week of October 3rd. For the first nine months of 2025, the fixed-ARM spread was 78 basis points, compared to a spread of 58 basis points for the corresponding period in 2024.

In this environment where borrowers are struggling with lack of affordability, moving to an ARM can result in real savings. For a $400,000 loan, a rate that is 78 basis points lower results in a monthly payment that is approximately $200 lower. It is not surprising that the ARM share has increased, and we expect it will increase further in 2026 as the yield curve is likely to steepen.

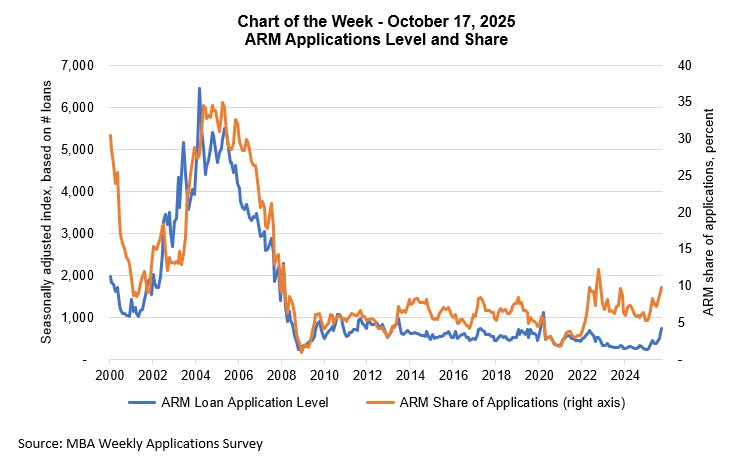

As shown in this week’s chart, based on data from MBA’s Weekly Applications Survey, the ARM share of all mortgage applications—represented by the orange line—averaged 10 percent in September, the highest share in almost two years and above the post-2008 average of 6 percent. The ARM share peaked at 35 percent in 2005, but that was a vastly different environment. Most ARM loans now have fixed terms of 5, 7, and 10 years and borrowers are underwritten to the fully indexed rate and are significantly less risky than ARM loans originated before 2008. A large share of ARMs are originated by depositories who keep these loans on portfolio. Additionally, borrowers who qualify for ARMs tend to have better credit profiles.

While the share of ARM applications has grown, the level of ARM loans remains relatively low. As indicated by the blue line in the chart, MBA’s ARM applications index, a measure of the number of ARMs applied for in a given period, reached a five-year high in September 2025, but that was approximately a tenth of the peak level observed in 2004 and a quarter of the 2000 to 2008 average.

We hope you will join us at the 2025 MBA Annual Convention in Las Vegas this weekend, which will feature our market outlook session covering the economy, housing and mortgage markets, and mortgage lender profitability.